Back to Blog

by Finage at July 24, 2021 4 MIN READ

Crypto

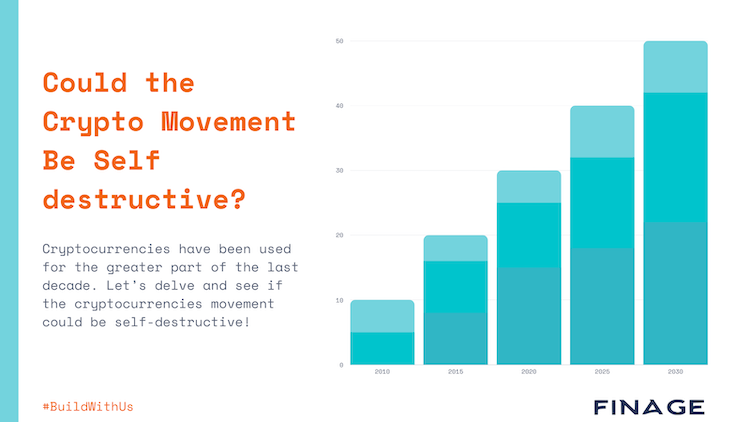

Could the Crypto Movement Be Self-destructive?

Cryptocurrencies have been used for the greater part of the last decade. As of July 2021, the number of blockchain wallet users worldwide has almost reached 80 million, with the numbers expected to continue to rise. That being said, it appears that cryptocurrency is beginning to veer away from its nature. Let’s delve deeper to understand what all of this means.

Contents:

Brief History

How the Crypto Self-limiting Structure Looks Like

Crypto Influencers

Final Thoughts

Brief History

Cryptocurrencies have been available for just over a decade. The first cryptocurrency, Bitcoin, was created by a Japanese student back in 2008. initially, it was merely a descriptive paper outlining a different mode of payment that would take place on decentralized markets.

The entirety of the paper was centered on the notion that ordinary citizens with financial difficulties could have a place where they didn’t have to worry about the limitations of currency. As a result, anyone with financial difficulties will be able to circumvent such pitfalls and achieve financial stability.

Bitcoin was then regarded as a game-changer that would decrease the wealth gap between the richest and poorest members of society. As a new practice, it posed a major threat to the more traditional means of economic influence such as the central banks and exchange markets. In a way, cryptocurrencies such as Bitcoin were seen as a rebellious gesture and the future looked promising.

How the Crypto Self-limiting Structure Looks Like

It is safe to assume that many individuals have benefited from blockchain wallets such as Bitcoin and many others that have been introduced since then. However, is it safe to assume that cryptocurrencies are serving the purpose they were intended to? The simple answer here is- not entirely.

One of the main selling points of a crypto coin is its incapability to be influenced by external factors. This key feature should enable it to be incorruptible and although this has shown major manifestations it could potentially occur. One of the major developments has been the rise of the “crypto influencers”.

These individuals promote the image and value of cryptocurrencies. Their message is simply to let the masses know that crypto is the future and the banks and other influencers of major economies are losing. That being said, this message is not entirely true and Bitcoin and other blockchain wallets have not yet achieved such a status.

The Banks are still dominating the flow of money on the centralized platform and it seems that this could be the case for a while. Why haven't cryptocurrencies achieved the status that was initially promised? Originally, the idea of a cryptocurrency was to exclude the middleman in business transactions. This was a revolutionary idea because many individuals would prefer such a reality. Although most coins have managed to do this, there are still a few things left out of the equation such as:

- Freedom for users

- Equality across the blockchain platforms

- Liberty

If you look at the nature of Bitcoin today, it’s quite obvious that only a select group of individuals have benefited from its rise. As such, it’s becoming similar to the system it was initially created to fight.

Crypto Influencers

This group of crypto influencers kept perpetuating the idea of economic freedom from the middleman. This message was well-received by the masses and even though Bitcoin can be directly influenced, it can be indirectly manipulated by a few skilled liars. Most of Bitcoin is not owned by the people but by major corporations who are keen on owning as much of it as possible. This means that the platform that was built for the people is slowly getting centralized and could permit the development of monopolies.

Most crypto traders nowadays don’t take part in the actual process of crypto mining. Platforms like Binance are being used for such purposes. If 60% of users do not own a wallet this could only mean that the blockchain is being run by a few individuals which further supports the notion of emerging crypto-based financial monopolies.

If you are looking for proof of how all of this is beginning to look like, just look at some of the major banks like JP Morgan, which are beginning to offer services centered around cryptocurrency. This alone defeats the purpose of having a decentralized blockchain in the first place. Unfortunately, such practices are becoming more mainstream and it seems like the banks and major corporations have found a way to infiltrate cryptomarkets.

Final Thoughts

The concept of Bitcoin outlined by Nakamoto was designed to prevent the rise of monopolies. It was created to be a platform that could not be influenced by a group of individuals and serve the common man. Nevertheless, this is not the case and it seems like crypto markets have almost been consumed as well.

So what does the future look like? It would be virtually impossible to reverse these changes and unfortunately, more corporations will aim to control as much of the decentralized market as possible.

If you have any questions about crypto deviation or would like to get real-time or historical stock data, see the Finage services! Get in touch if you are looking for API and reliable data for your financial app.

You can start building your own Cryptocurrency Trading Platform with Finage free Cryptocurrency API key.

Build with us today!

Featured Posts

Sector Focus: Which CFDs Are Investors Watching Closely This Year?

April 24, 2024

What's New at Finage: Latest Features and Services for 2024

April 23, 2024

Predictive Analytics in Stock Market Investments: Latest Tools and Techniques

April 22, 2024

NFTs in the Entertainment Niche & Its Role in the Web3 Ecosystem

April 21, 2024

DeFi in 2024: Exploring the Growth & Impact on Traditional Financial Services

April 20, 2024

Categories

Forex

Finage Updates

Stocks

Real-Time Data

Finage News

Crypto

ETFs

Indices

Technical Guides

Financial Statements

Excel Plugin

Web3

Tags

brief story of cryptocurrency

quant data crypto api

apis for quants

apis for also traders

cryptocurrency ticker api

ticker api

bitcoin price api

historical market cap api

historical crypto api

Join Us

You can test all data feeds today!

Start Free Trial

If you need more information about data feeds, feel free to ask our team.

Request Consultation

Back to Blog

Please note that all data provided under Finage and on this website, including the prices displayed on the ticker and charts pages, are not necessarily real-time or accurate. They are strictly intended for informational purposes and should not be relied upon for investing or trading decisions. Redistribution of the information displayed on or provided by Finage is strictly prohibited. Please be aware that the data types offered are not sourced directly or indirectly from any exchanges, but rather from over-the-counter, peer-to-peer, and market makers. Therefore, the prices may not be accurate and could differ from the actual market prices. We want to emphasize that we are not liable for any trading or investing losses that you may incur. By using the data, charts, or any related information, you accept all responsibility for any risks involved. Finage will not accept any liability for losses or damages arising from the use of our data or related services. By accessing our website or using our services, all users/visitors are deemed to have accepted these conditions.