Back to Blog

by Finage at August 1, 2021 5 MIN READ

Financial Statements

What is an Income Statement? | Financial Statements Data APIs

All the details about the income statement, which is one of the important financial statements used to report the financial performance of a company are in our blog.

Table of Contents

What is an Income Statement?

Understanding the Income Statement

Revenues and Gains

Expenses and Losses

Usage Areas of Income Statements

What is an Income Statement?

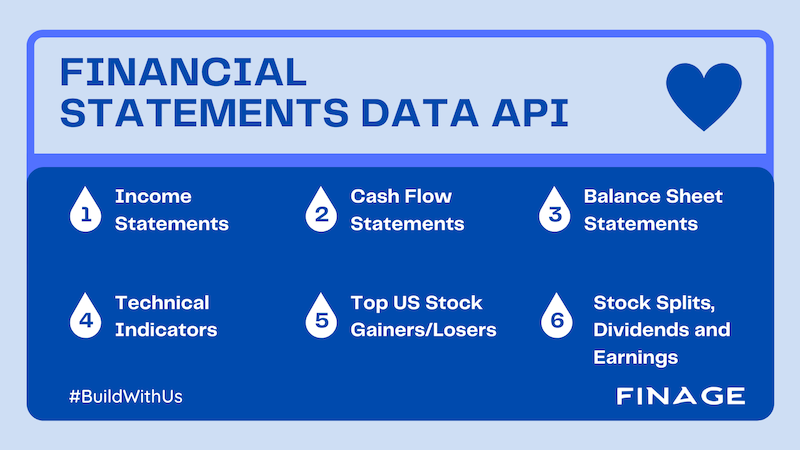

The income statement is one of the three important financial statements used to report a company's financial performance over a given accounting period, and the other two important statements are the balance sheet and the cash flow statement. It is also known as the profit and loss statement or the income and expense statement. Firstly, it focuses on the company's income and expenses for a particular period.

Important Implements

The income statement is one of the three main financial statements (along with the balance sheet and cash flow statement) that report a company's financial performance over a given accounting period.

Net Income = (Total Income + Earnings) – (Total Expenses + Loss)

Total income is the sum of both operating and non-operating income, while total expenses include those arising from primary and secondary activities.

Revenues are not receipts. Income is earned and reported on the income statement. The income statement provides valuable information about a company's operations, the efficiency of its management, underperforming industries, and its performance relative to industry peers.

Understanding the Income Statement

The income statement is a crucial part of a company's performance reports that must be submitted to the Securities and Exchange Commission . The income statement focuses on four key items: income, expenses, gains and losses. It does not distinguish between cash and non-cash receipts or cash and non-cash payments. It starts with details of sales and then works to calculate net income and ultimately earnings per share. In fact, it gives an account of how the net income realized by the company is converted into net income.

Revenues and Gains

Income generated through primary activities is often referred to as operating income. For a company that manufactures a product, or for a wholesaler, distributor, or retailer engaged in the business of selling that product, revenue from primary activities refers to revenue from the sale of the product. Similarly, for a company engaged in the business of providing services, income from primary activities represents income or fees earned in exchange for providing those services.

Income generated through secondary, non-core business activities is often referred to as non-operating recurring income. These incomes are derived from earnings other than the purchase and sale of goods and services and may include interest income from working capital in the bank, rental income from commercial properties, income from strategic partnerships such as royalty payment receipts from income.

Earnings, also called other income, represent net money from other activities, such as the sale of long-term assets. These include net income from one-time non-commercial activities such as a company selling the old haul truck, unused land, or a subsidiary.

Income should not be confused with receipts. Revenue is generally recognized in the period in which sales are made or services are rendered. Receipts are cash received and are accounted for when money is actually received. For instance, a customer may purchase goods/services from a company on September 28, resulting in revenue recognition in September. Due to its good reputation, the client may be given a 30-day payment window. He will give himself until October 28 to make the payment for which the receipts are accounted for.

Expenses and Losses

All expenses incurred to generate normal operating income associated with the main activity of the business. These include cost of goods sold, selling, general and administrative expenses, depreciation, and research and development expenses. Typical items that make up the list are; employee wages, sales commissions, and utilities expenses such as electricity and transportation.

Primary income and expenses provide insights into how well the company's core business is performing. Secondary income and expenses take into account the company's expertise in managing temporary, non-core activities. A significantly higher interest income from the money in the bank, compared to the income from the sale of finished goods, indicates that the enterprise may not be able to use the available cash to its full potential by expanding its production capacity, or it is facing difficulties in production.

Income Statement Structure

Mathematically, Net Income is calculated based on:

Net Income = (Income + Earnings) – (Expense + Loss)

Usage Areas of Income Statements

The main purpose of the income statement is to convey the details of the company's profitability and business activities to the stakeholders. It also provides detailed information about the internal structure of the company for comparison between different businesses and industries. Such statements are prepared more frequently by company management at department and segment levels to gain deeper insights to check the progress of various activities throughout the year, but such interim reports may remain within the company.

Based on income statements, management can make decisions such as expanding into new geographies, pushing sales, increasing production capacity, increasing use of assets or selling directly, or closing a department or product line. Competitors can also use them to gain insight into a company's parameters of success and areas of focus as increased R&D spending.

Creditors may find income statements of limited use because they are more concerned with a company's future cash flows rather than its past profitability. Research analysts use the income statement to compare year-to-year and quarter-to-quarter performance. It can be inferred whether a company's efforts to reduce cost of sales are helping to increase profits over time, or whether management has managed to keep track of operating expenses without sacrificing profitability.

Underline

The income statement provides valuable information about various aspects of a business. It includes a company's operations, the efficiency of its management, potential areas of leaks that could erode profits, and whether the company is performing in line with its industry peers.

We hope that this blog post will be beneficial for you. We will continue to create useful works in order to get inspired by everyone. We are sure that we will achieve splendid things all together. Keep on following Finage for the best and more.

You can start building your own Data Analytics Platform with Finage free Fundamentals API key.

Build with us today!

Featured Posts

Why Crypto & Blockchain Are So Important in 2024?

April 18, 2024

Emerging Markets and Their Influence on Global Stock Indices

April 17, 2024

Web3 Security Challenges and Solutions

April 16, 2024

Quantum Computing and Its Potential Impact

April 15, 2024

Global Economic Policies on Forex and Stock Markets

April 14, 2024

Categories

Forex

Finage Updates

Stocks

Real-Time Data

Finage News

Crypto

ETFs

Indices

Technical Guides

Financial Statements

Excel Plugin

Web3

Tags

What is an Income Statement?

Understanding the Income Statement

Revenues and Gains

Expenses and Losses

Usage Areas of Income Statements

Join Us

You can test all data feeds today!

Start Free Trial

If you need more information about data feeds, feel free to ask our team.

Request Consultation

Back to Blog

Please note that all data provided under Finage and on this website, including the prices displayed on the ticker and charts pages, are not necessarily real-time or accurate. They are strictly intended for informational purposes and should not be relied upon for investing or trading decisions. Redistribution of the information displayed on or provided by Finage is strictly prohibited. Please be aware that the data types offered are not sourced directly or indirectly from any exchanges, but rather from over-the-counter, peer-to-peer, and market makers. Therefore, the prices may not be accurate and could differ from the actual market prices. We want to emphasize that we are not liable for any trading or investing losses that you may incur. By using the data, charts, or any related information, you accept all responsibility for any risks involved. Finage will not accept any liability for losses or damages arising from the use of our data or related services. By accessing our website or using our services, all users/visitors are deemed to have accepted these conditions.